The thermoform packaging market represents a significant segment of the global packaging industry, centered on solutions derived through the thermoforming process. This method involves heating thermoplastic sheets such as PET, PVC, or PP until they are pliable, molding them into specific designs, and cooling them to form durable packaging products. Thermoformed packaging includes blister packs, clamshells, trays, and containers, providing lightweight, cost-efficient, and highly customizable solutions. Industries including food and beverages, pharmaceuticals, electronics, and consumer goods depend on this packaging for enhanced shelf life, tamper evidence, and efficiency in mass production. Rising consumer demand, technological advancements, and sustainability considerations are shaping the market trajectory.

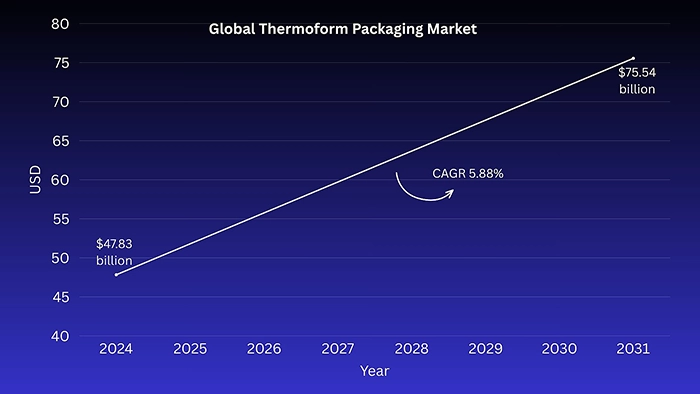

The global thermoform packaging market was valued at USD 47.83 billion in 2024 and is forecasted to reach USD 75.54 billion by 2032, expanding at a CAGR of 5.88% from 2026 to 2032. Growth is driven by rising demand from food and beverage industries, stringent pharmaceutical packaging standards, the rapid expansion of e-commerce, and technological advancements in thermoforming processes. The market is characterized by its ability to combine product visibility, protection, and cost efficiency, making thermoform packaging a preferred solution across multiple sectors.

The global thermoform packaging market was valued at USD 47.83 billion in 2024 and is forecasted to reach USD 75.54 billion by 2032, expanding at a CAGR of 5.88% from 2026 to 2032. Growth is driven by rising demand from food and beverage industries, stringent pharmaceutical packaging standards, the rapid expansion of e-commerce, and technological advancements in thermoforming processes. The market is characterized by its ability to combine product visibility, protection, and cost efficiency, making thermoform packaging a preferred solution across multiple sectors.

Key Trends and Insights

The food and beverage industry is a primary catalyst for market growth, fueled by modern lifestyles, urbanization, and increasing disposable incomes. There is a significant rise in demand for ready-to-eat meals, frozen foods, and pre-packed perishables, and thermoformed trays, containers, and lids play a critical role in extending shelf life and maintaining food safety. The pharmaceutical and healthcare sectors also contribute substantially to growth due to their stringent requirements for sterile, tamper-evident, and unit-dose packaging. Thermoforming is widely used for blister packs, medical devices, and other pharmaceutical products because it meets rigorous regulatory standards and ensures hygiene and safety.

The rapid shift toward e-commerce and online retail has increased the demand for packaging that can withstand handling and transportation while providing convenience for consumers. Lightweight and durable thermoform packaging fulfills these requirements, enhancing product protection and consumer satisfaction. Sustainability is another emerging trend, with manufacturers adopting recycled content such as rPET, bio-based polymers, and recyclable designs to comply with regulatory mandates like the EU Single-Use Plastics Directive and to meet consumer expectations. Technological advancements in machinery, automation, robotics, and materials science are improving production speed, precision, and customization while allowing for complex designs and enhanced aesthetics. Emerging markets in Asia-Pacific and Latin America are witnessing strong demand due to urbanization, rising disposable income, and the expansion of organized retail and cold chain infrastructure.

Market Challenges

The thermoform packaging market faces challenges primarily from environmental and regulatory pressures targeting plastics, particularly single-use materials. Governments in Europe and North America are imposing stricter regulations, including bans and extended producer responsibility schemes, while consumers increasingly prefer biodegradable or bio-derived packaging, which can be costlier or less functional than traditional plastics. Inadequate recycling infrastructure further limits the sustainability of thermoformed packaging, particularly when multi-layer or composite materials are used, resulting in significant waste ending up in landfills. The market is also vulnerable to fluctuations in petroleum-based resin costs, which affect profit margins. High initial capital investment for specialized thermoforming machinery and tooling presents barriers to new entrants and smaller manufacturers. Additionally, competition from alternative packaging solutions, including flexible pouches, rigid molded products, and paper-based materials, challenges market share. Material performance limitations, such as suboptimal barrier properties and restricted heat resistance, can also constrain the adoption of thermoform packaging in certain applications.

Market Opportunities and Growth Prospects

The thermoform packaging market presents several opportunities for expansion, particularly through the adoption of recyclable and bio-based polymers, innovations in flexible packaging, and the incorporation of smart packaging elements that enhance branding, traceability, and consumer engagement. Emerging markets offer substantial growth potential as urbanization, disposable income, and industrial development drive the demand for packaged foods, pharmaceuticals, and consumer goods. The ongoing emphasis on sustainability, coupled with technological improvements in thermoforming processes, ensures that both rigid and flexible packaging solutions remain highly relevant across industries.

Rigid thermoform packaging dominates the market, representing over 60% of revenue due to its protective qualities, tamper-evidence, and structural integrity. Products such as blisters, clamshells, trays, and containers are essential in pharmaceuticals, electronics, and food & beverage applications. Flexible thermoform packaging is gaining traction for its lightweight, low-material-usage properties, particularly in consumer goods and personal care sectors, where thin-blister cards or skin packaging improve cost efficiency and product visibility. Vacuum forming is the leading technology for high-volume, thin-gauge applications, while pressure forming is used in high-precision packaging, particularly in medical devices, pharmaceuticals, and electronics. Both technologies are benefiting from digitalization, sustainability initiatives, and the adoption of recyclable and bio-based polymers.

Regional Insights

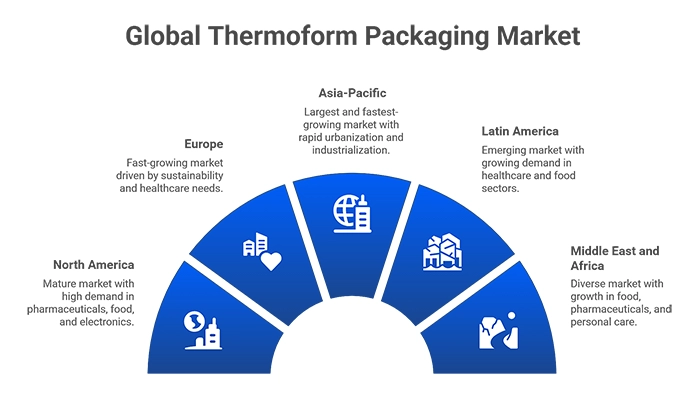

North America continues to represent a mature and technologically advanced market for thermoform packaging, with the United States at its core, boasting a high concentration of key manufacturers and end-use companies. The region dominates global market share, driven by strong demand across pharmaceuticals, convenience foods, and electronics sectors. In the pharmaceutical domain, the U.S. leads globally, with thermoform blister packaging highly favored for unit-dose medications due to its protective, tamper-evident, and child-resistant features, meeting rigorous safety and regulatory standards. The food and beverage sector also propels growth, as on-the-go consumption, frozen products, bakery items, and prepared meals create significant demand for thermoformed containers and trays that provide secure sealing and extended shelf life. Additionally, the electronics industry increasingly relies on lightweight and protective thermoform packaging for components and devices, reflecting the region’s high-tech industrial base. Current trends further indicate a strong emphasis on sustainability, with manufacturers innovating through recycled PET (rPET), bio-based polymers, and design approaches that enhance recyclability, while automation in production is improving operational efficiency and reducing costs.

North America continues to represent a mature and technologically advanced market for thermoform packaging, with the United States at its core, boasting a high concentration of key manufacturers and end-use companies. The region dominates global market share, driven by strong demand across pharmaceuticals, convenience foods, and electronics sectors. In the pharmaceutical domain, the U.S. leads globally, with thermoform blister packaging highly favored for unit-dose medications due to its protective, tamper-evident, and child-resistant features, meeting rigorous safety and regulatory standards. The food and beverage sector also propels growth, as on-the-go consumption, frozen products, bakery items, and prepared meals create significant demand for thermoformed containers and trays that provide secure sealing and extended shelf life. Additionally, the electronics industry increasingly relies on lightweight and protective thermoform packaging for components and devices, reflecting the region’s high-tech industrial base. Current trends further indicate a strong emphasis on sustainability, with manufacturers innovating through recycled PET (rPET), bio-based polymers, and design approaches that enhance recyclability, while automation in production is improving operational efficiency and reducing costs.

Europe is among the fastest-growing markets globally, although its expansion is heavily influenced by stringent environmental regulations and a strong public push for sustainability. The European market is witnessing a major transition away from conventional plastics toward eco-friendly alternatives. Regulatory frameworks, including the EU Packaging and Packaging Waste Directive (PPWD) and the Circular Economy Action Plan, are compelling companies to adopt recyclable and reusable packaging solutions, providing opportunities for mono-material thermoformed products. The growing healthcare sector, fueled by an aging population, drives demand for high-quality, sterile packaging for medicines and medical devices. At the same time, consumer preferences for fresh, chilled, and ready-to-eat meals—particularly in countries like Germany, the UK, and France—boost the use of thermoformed trays and containers. Current market trends reflect a clear focus on sustainability and circularity, with high demand for rPET and paperboard or molded fiber alternatives, while innovation targets mono-material designs that balance cost-effectiveness with environmental performance.

The Asia-Pacific region stands out as both the largest and fastest-growing market for thermoform packaging, propelled by rapid urbanization, industrialization, and a massive consumer base in emerging economies such as China and India. Rising disposable incomes, coupled with expanding organized retail and e-commerce channels, are increasing the consumption of packaged, ready-to-eat, and convenience foods. The region’s status as a global manufacturing hub, particularly in electronics and consumer goods, generates enormous demand for protective thermoform packaging, including clamshells and detailed trays for shipping, display, and retail purposes. While cost-effectiveness and high-volume production remain dominant priorities, there is a gradual rise in sustainability awareness, especially in more developed markets like Japan, signaling future adoption of recyclable and bio-based materials.

Latin America represents an emerging market with evolving consumer preferences, industrial growth, and increasing disposable income driving the need for modern packaging solutions. Investments in healthcare and technical development, particularly in countries like Brazil, are boosting demand for thermoformed medical and pharmaceutical packaging. Rapidly changing lifestyles and growing consumption of processed and packaged foods are further contributing to higher adoption of thermoformed trays and containers. Favorable demographics, including population growth and industrial expansion, underpin the long-term market potential. Current trends in the region emphasize low production costs and operational efficiency, with sustainability concerns beginning to gain traction, while immediate priorities focus on providing secure, hygienic, and cost-effective packaging for fast-moving consumer goods and medical products.

The Middle East and Africa exhibit diverse levels of market maturity. In the Middle East, particularly in GCC countries, strong economic growth, high consumer purchasing power, and tourism-driven demand are fueling rapid adoption of thermoform packaging, especially in food, pharmaceuticals, and personal care segments. Infrastructure development and expanding healthcare systems are attracting pharmaceutical investment, creating strong demand for blister packs and other protective packaging formats. Meanwhile, African countries are emerging markets, where urbanization, lifestyle changes, and the shift from unbranded to branded packaged foods are driving adoption from a low base. Current trends indicate the expansion of thermoform packaging in food and healthcare sectors due to its protective and hygienic properties, while premium, visually appealing packaging is gaining traction in cosmetics and personal care. Environmental considerations are gradually influencing policy in parts of the Middle East, suggesting a future shift toward more sustainable materials and packaging practices.

Conclusion

The thermoform packaging market is poised to witness sustained and robust growth over the forecast period, underpinned by strong and increasing demand from key sectors such as food and beverages, pharmaceuticals, healthcare, and consumer goods. The food and beverage segment continues to expand rapidly due to changing consumer lifestyles, rising disposable incomes, and the growing preference for ready-to-eat, frozen, and pre-packed products, which rely heavily on thermoformed solutions for protection, shelf-life extension, and aesthetic appeal. Similarly, the pharmaceutical and healthcare industries are driving market expansion through their stringent requirements for sterile, tamper-evident, and unit-dose packaging, particularly in blister packs and specialized medical trays, which ensure compliance with global regulatory standards and safeguard patient safety.

Beyond these core sectors, the market is being shaped by ongoing technological advancements in thermoforming machinery, automation, precision tooling, and materials science, which collectively enhance production efficiency, customization capabilities, and design complexity. Sustainability considerations, driven by regulatory mandates and growing consumer awareness, are further influencing market strategies, prompting the adoption of recycled PET, bio-based polymers, and mono-material designs that improve recyclability and reduce environmental impact. These dynamics, coupled with the growing adoption of vacuum and pressure forming technologies for high-volume and specialized packaging needs, underscore the sector’s capacity for innovation and adaptation in a competitive landscape.

By 2032, the thermoform packaging market is projected to reach USD 75.54 billion, reflecting not only consistent growth but also the increasing strategic importance of thermoformed packaging in global supply chains. Its lightweight yet robust design, cost efficiency, and versatility make it indispensable across a variety of end-use applications, ranging from mass-market consumer goods to high-value pharmaceuticals and medical devices. The market’s expansion highlights its continued relevance and critical role in modern packaging while also emphasizing the opportunities for manufacturers, brand owners, and suppliers to innovate, optimize sustainability, and meet evolving consumer and regulatory demands worldwide.