The Growth of Express and Same-Day Air Freight in E-Commerce Logistics

The e-commerce revolution has fundamentally reshaped consumer expectations, transforming overnight delivery from a premium service into a standard expectation. This shift has catalyzed unprecedented growth in express and same-day air freight services, creating a logistics ecosystem where speed has become the primary differentiator. As online shopping continues its relentless expansion, reaching projected sales of 6.3 trillion dollars by 2024, the air cargo industry finds itself at the center of a transformation that demands rapid adaptation and innovative solutions.

The convergence of consumer expectations, technological capabilities, and competitive pressures has created a perfect storm driving express air freight growth. E-commerce platforms compete aggressively on delivery speed, with same-day and next-day options becoming standard offerings rather than premium services. This evolution has positioned express air freight as an essential component of modern retail strategy, fundamentally altering how companies approach inventory management, distribution planning, and customer satisfaction.

Market Dynamics and Growth Trajectories

The statistics surrounding express air freight growth in e-commerce present a compelling narrative of transformation. Current data indicates that e-commerce represents approximately one-third of all air cargo volumes, a figure that has tripled from just 10 percent in 2017. This dramatic increase reflects not only the growth of online shopping but also the increasing reliance on air transportation for rapid fulfillment of consumer expectations.

Industry projections suggest that express shipments will account for 25 percent of all air cargo business by 2043, with growth rates significantly exceeding traditional cargo segments. Express carriers are experiencing annual volume growth of 5.8 percent compared to 3.6 percent for general cargo, a differential that underscores the market’s shift toward speed-focused services.

The same-day delivery market alone is projected to reach 29.82 billion dollars by 2030, growing at a compound annual growth rate of 20.6 percent from 2025 to 2030. This explosive growth reflects consumer willingness to pay premiums for immediate gratification and the competitive necessity for retailers to offer rapid delivery options.

Regional variations in express air freight growth reveal interesting patterns tied to economic development and consumer behavior. Asia Pacific markets lead in volume growth at 16.7 percent annually, driven by massive e-commerce expansion in countries like China and India. European markets follow with 14.2 percent growth, while North American markets show more moderate but still substantial growth rates of 6.6 percent.

E-Commerce Platforms and Air Freight Integration

Major e-commerce platforms have become the primary drivers of express air freight demand, fundamentally altering traditional shipping patterns and service requirements. Amazon’s influence extends beyond its own logistics operations to reshape industry standards and consumer expectations across all retail segments.

The platform’s two-day Prime delivery standard has evolved into same-day expectations in many urban markets, forcing competitors to match or exceed these service levels. This competitive pressure has created sustained demand for express air services, particularly during peak shopping periods and for high-value or time-sensitive products.

Cross-border e-commerce represents a particularly dynamic growth segment, with air cargo handling approximately 80 percent of international e-commerce goods. The rapid expansion of platforms like Alibaba, Amazon Global, and regional marketplace operators has created new routing patterns and service requirements that favor air transportation over traditional ocean freight.

The rise of direct-to-consumer fulfillment models has further accelerated express air freight demand. As Chinese and other international retailers establish direct relationships with consumers worldwide, traditional wholesale distribution patterns are giving way to individual package shipments that require rapid, reliable air transportation.

Operational Challenges and Solutions

The growth of express and same-day air freight presents significant operational challenges that require innovative solutions and substantial infrastructure investment. Capacity constraints represent one of the most pressing issues, as traditional cargo aircraft and passenger flights struggle to accommodate the surge in small-package shipments requiring rapid handling.

Airlines have responded by investing heavily in dedicated freighter capacity, with Boeing projecting a two-thirds increase in the global freighter fleet by 2043 to meet express shipping demand. This expansion includes both new aircraft orders and passenger-to-freighter conversions that provide additional capacity specifically configured for e-commerce requirements.

Ground handling operations have undergone substantial transformation to accommodate the unique requirements of express e-commerce shipments. Traditional cargo handling processes designed for large, consolidated shipments prove inadequate for the high-volume, small-package flows that characterize e-commerce fulfillment.

Automated sorting systems, robotic handling equipment, and real-time tracking technologies have become essential investments for airports and cargo facilities serving express markets. These systems enable the rapid processing and accurate routing required for same-day and next-day delivery commitments.

Technology Integration and Digital Transformation

The express air freight sector has become a testing ground for advanced logistics technologies that enable rapid, accurate, and cost-effective operations. Digital booking platforms now handle 73 percent of air cargo capacity, simplifying the process for e-commerce companies to secure space quickly and efficiently.

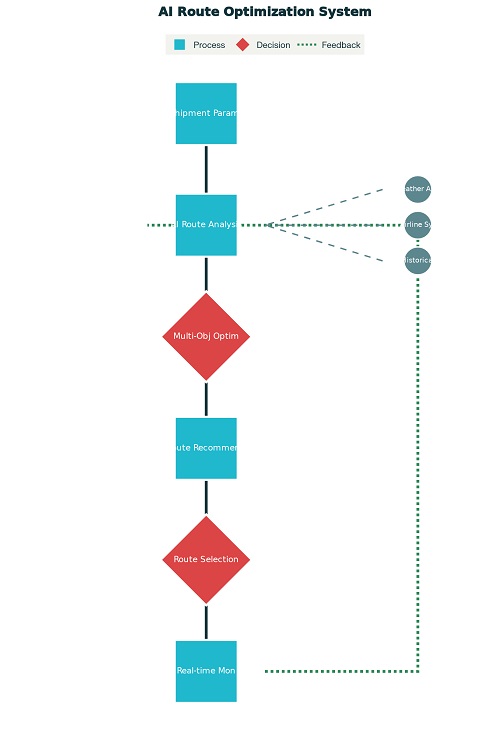

Artificial intelligence and machine learning applications optimize route selection, capacity allocation, and demand forecasting to improve service reliability and cost efficiency. These systems analyze patterns in e-commerce ordering, seasonal fluctuations, and consumer behavior to predict capacity requirements and optimize resource allocation.

Internet of Things sensors and real-time tracking systems provide the visibility and monitoring capabilities essential for express shipments where timing is critical. These technologies enable proactive exception management and provide customers with the real-time status updates they expect for urgent deliveries.

Blockchain technology is beginning to streamline documentation processes and improve supply chain transparency, reducing administrative delays that can compromise express delivery commitments. Smart contracts automate various aspects of the shipping process, from booking confirmation to payment processing.

Last-Mile Integration and Multimodal Coordination

Express air freight success depends heavily on seamless integration with last-mile delivery networks that can maintain service speed and reliability from airport to final destination. The growth of dedicated delivery networks, crowdsourced drivers, and innovative last-mile solutions has created new possibilities for extending express service capabilities.

Urban air mobility concepts, including drone delivery and autonomous vehicle networks, represent emerging solutions for overcoming last-mile bottlenecks that constrain express delivery capabilities. While regulatory and technical challenges remain, pilot programs demonstrate the potential for these technologies to extend same-day delivery reach and reduce costs.

Multimodal coordination has become increasingly sophisticated, with express carriers developing integrated networks that combine air transportation with optimized ground delivery systems. These networks leverage real-time data and predictive analytics to coordinate timing and capacity across different transportation modes.

Sustainability and Environmental Considerations

The rapid growth of express air freight presents significant environmental challenges that the industry must address to ensure long-term sustainability. Air transportation generates substantially higher carbon emissions per shipment compared to ground or ocean alternatives, raising concerns about the environmental impact of consumer demand for rapid delivery.

Industry initiatives focus on improving fuel efficiency, developing sustainable aviation fuels, and optimizing routing to reduce environmental impact while maintaining service quality. Carbon offset programs and environmental reporting provide mechanisms for companies to address emissions while meeting express delivery requirements.

Consolidation strategies that combine multiple small shipments into fewer flights represent one approach to reducing environmental impact per delivered item. Advanced algorithms identify consolidation opportunities that maintain delivery speed while improving environmental efficiency.

Economic Impact and Industry Transformation

The growth of express air freight has created substantial economic impact across the entire logistics ecosystem, generating employment opportunities and driving infrastructure investment worldwide. Airports have invested billions in expanding cargo facilities and upgrading handling capabilities to serve express markets.

The transformation has also disrupted traditional logistics relationships and pricing structures, with express services commanding premium rates while traditional cargo faces increased competition from ocean and ground alternatives. This shift has forced carriers to reevaluate their service portfolios and competitive positioning.

Regional economic development has benefited significantly from express air freight growth, with airports and logistics hubs becoming focal points for e-commerce distribution centers and related businesses. The clustering effect creates economic multipliers that extend benefits throughout local economies.

Future Outlook and Strategic Implications

Looking ahead, the growth trajectory of express air freight in e-commerce appears likely to continue, driven by expanding global internet penetration, growing consumer affluence in developing markets, and continued evolution of retail models toward instant gratification.

Technological advancements promise to further enhance express capabilities while potentially reducing costs and environmental impact. Autonomous aircraft, improved automation, and advanced materials may enable new service levels and efficiency improvements that support continued growth.

The integration of express air freight with emerging retail concepts like augmented reality shopping, instant commerce, and personalized fulfillment will create new demands and opportunities for service innovation. Companies that successfully adapt to these evolving requirements will capture disproportionate value in the expanding express logistics market.

Strategic success in the express air freight sector will require continued investment in technology, infrastructure, and partnerships that enable rapid adaptation to changing market conditions and customer requirements. As e-commerce continues reshaping global retail patterns, express air freight services will remain essential enablers of the digital economy’s continued expansion.